Fink's Folly, Part 1

Blackrock's Alt-Enhanced Target Date Funds: Hard pass, Thanks.

Today, in part 1 of a 2-part series (so exciting!) we focus on the expected/prospective returns of the proposed BlackRock Target Date Fund, enhanced with Alts, vs. BlackRock’s existing cheap, liquid, flexible TDFs.

It’s Finally Here!

In June, BlackRock announced its plans to put (jam?) Alternative Investments in 401(k)s, with a planned rollout starting in 2026. Jason Zweig recently said it very well, very succinctly, and we agree: it seems a bad idea.

We could just leave it there, but in the upside-down world of Presidential Decrees re: Alts in 401(k)s, and the industry stoking fears of litigation for those that DON’T invest in Alts, i.e.: “join the party-OR ELSE,” we thought maybe we should cover-and perhaps help others to cover-- our Alts-Free Asses, as it were.

Herewith is the AltView’s initial due diligence of the BlackRock, or more accurately, BlackRock/Great Grey/Wilshire offering (we aren’t sure quite what to call it, part 2 will discuss in detail) and the BlackRock research that supports it.

Highlights:

1. BlackRock says investing with Alts in TDFs could generate .5%, or 50 basis points (bp) per annum in incremental annual returns, or a 15% bigger nut at retirement. 50bp per annum is a nice round number; unfortunately for fee-paying Blackrock investors, it is a BEFORE FEE projection. An after-fee (fees are 38bp per the WSJ) projection that otherwise accepts BlackRock’s assumptions (we wouldn’t, but anyway) would be less than half that: 21bps per annum. This math gets us ~6% extra money at retirement rather than 15%.

2. BlackRock’s approach swaps out public equity for private equity, and public debt for private debt. Like simply increasing the equity allocation in a stock/bond portfolio, this makes the portfolio riskier: of course the expected return should be higher….

3. BlackRock’s projections assume investment in only the Alts it currently expects to win (Private Equity and Private Debt, in BlackRock’s case). Expected Alts ‘losers’ like Real Estate and Infrastructure are omitted. BlackRock suggests that in the future, they will be able to successfully adjust Alts exposures over time. Our take: Maybe.

4. BlackRock’s projections call for yawning pre-fee performance gaps between Private Equity vs. Global Equities (3.3% per annum) and Private Debt/High Yield Bonds (4.2% per annum). For 40 years.

Show me the (wee bit more) money!

Just before the big announcement, BlackRock released a study touting the advantages of Alternatives, saying that an Alts-enhanced TDF could produce returns that allow an investor to retire with 15% more money than one that would not:

Source: BlackRock

We salute BlackRock for their willingness to use actual numbers to describe how much better returns might be using Alts. We are soooo sick of hearing junior-varsity Alts-peddlers whisper “illiquidity premium,” expecting investors to whip out their checkbook. Save that for the suburban dentists, guys.

Actual numbers give fiduciaries something to work with, even if (because of BlackRock’s giant, obvious agency conflict) a good fiduciary would certainly not rely on these and source their own, agency-conflict free expectations (aside: this would rule out most investment consultants too). Anyway, kudos.

It’s like Airbnb circa 2020

However, the “~15% more money in retirement” figure, and 50bp in return uplift, are most unhelpfully, before fees. From the WSJ:

Maybe BlackRock could take a cue from Airbnb and include those pesky charges, you know, the ones we all must pay-- in their figures. Transparency would make the purchasing decision easier.

Per the WSJ, that the overall fees for the Alt-enhanced TDF are planned to be 38bps, or more than four times the current fee on BlackRock’s LifePath TDF K shares sans Alts, of 9bps:

Netting out for the difference in fees and expected incremental return for the TDF with alts, we have a product that offers an incremental return of just twenty-one basis points per annum. Instead of a next egg that is 15% bigger, the new retiree gets one that is just 6.3% bigger.

Leaving aside the questions about BlackRock’s other assumptions for a moment, a quick question:

Is that good?

Here’s an idea: How about instead taking the company match up from 3% to, say 3.21%?

And while no prudent fiduciary should be averse to paying fees when justified, does it seem like BlackRock’s incentives are aligned with investors?

Consider: Investor fees paid will go up more than four times (for sure), while investor returns may go up by 21bps per annum?

Wait. What’s that smell? Ahhh, it is the stink of agency conflict. It’s worse in summer when it is humid.

More Risk=More Expected Return. AMIRITE?

Per the report, improved returns can be achieved by replacing publicly traded debt and equity with equal amounts of private debt and equity:

Sourcce: BlackRock

Swapping equal amounts of public debt and public equity for private debt and private equity gives you a riskier portfolio. Higher expected returns should be table stakes, not grounds for back-slapping.

Think about it. This is not unlike taking the 2065 TDF vintage from a 95% public equity allocation to 100%. Aside: if you assume (reasonably, we think, and BlackRock’s assumptions do, too) that equities will return 3% better than bonds per annum and you added 5% to your equity allocation, you’d get 15 basis points of incremental return per annum (AND you’d stay liquid).

For reasons we think we know, Blackrock does not mention this option in its research.

We can pick the best Alt asset classes- in advance. Potentially.

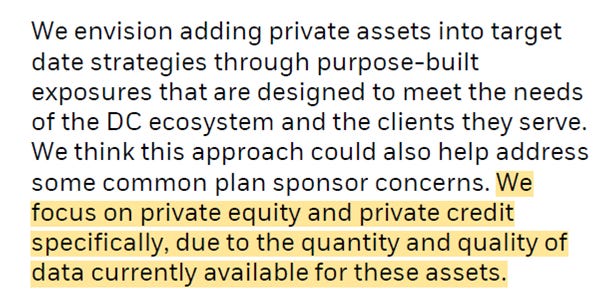

BlackRock’s paper goes on to note that not all alternatives make it into its’ “15% more money at retirement” portfolio-only private equity and private credit do:

The reason given is that BlackRock has the data to do this:

A thought: is BlackRock resource-constrained? If only they had access to more data. Like, they could beef things up by buying a private markets data company, something like that.

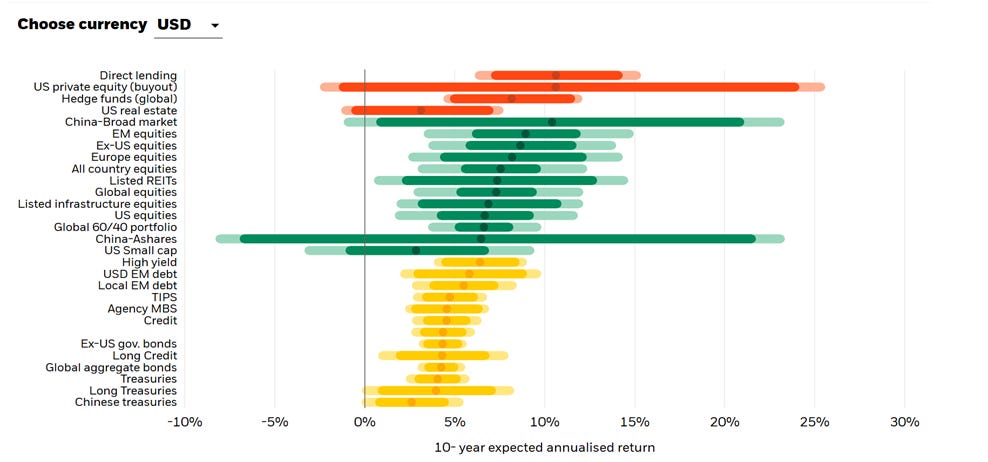

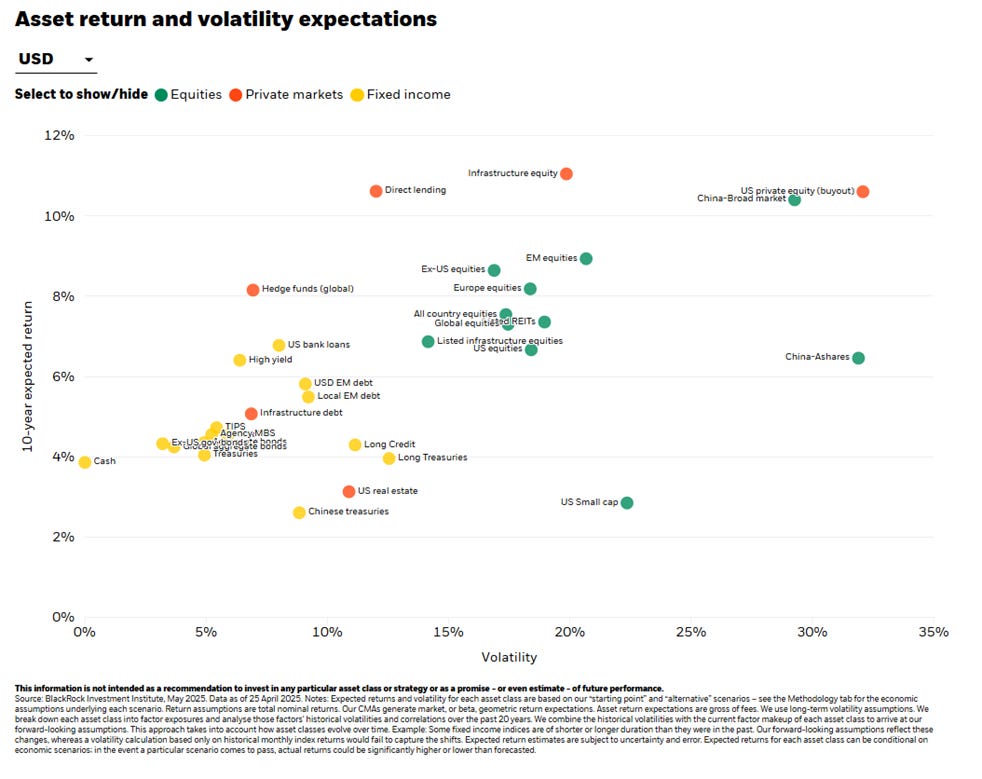

Us: we wonder whether it is just a coincidence that these assets with “quantity and quality of data” have, per BlackRock’s current capital market assumptions, a remarkably high expected return compared with other private assets:

Specifically, BlackRock’s projections show pre-fee performance gaps between Private Equity vs. Global Equities of (3.3% per annum) and Private Debt/High Yield Bonds (4.2% per annum). For 40 years.

Alts with lower (pre-fee) expected returns, like US Real Estate (3.1%), and Infrastructure Debt (5.1%) do not make their way into the hypothetical-but soon to be real- TDF.

Tactical Alts Allocators?

BlackRock’s assumptions reveal that they do not expect “All Alts to Always Win,” and suggest that they can ‘time the Alts market’, as it were. Maybe.

You can drive a truck through the gap between BlackRock’s current highest (pre-fee) Alts expected return, in infrastructure equity (11%) and the worst, US real estate (3.1%).

https://www.BlackRock.com/ca/institutional/en/insights/charts/capital-market-assumptions

In summary, the AltView view: if BlackRock can successfully sell it, this product is Great for BlackRock and its shareholders. It seems not so great for BlackRocks’ client-investors, even if one accepts BlackRock’s own return forecasts. And surely prospective investor-fiduciaries would not blindly accept them. Would they?

Be careful out there, fiduciaries!

Resources:

WSJ: BlackRock Deepens Push into Private Investments for the Masses

https://www.wsj.com/personal-finance/BlackRock-private-credit-push-f3ee910c?mod=Searchresults_pos7&page=1

WSJ: Wall Street’s Big, Bad Idea for Your 401(k)

https://www.wsj.com/finance/investing/wall-streets-big-bad-idea-for-your-401-k-f1003137?mod=Searchresults_pos10&page=1

BlackRock’s study “How Private Markets Could improve retirement outcomes”

https://www.BlackRock.com/us/financial-professionals/practice-management/alternatives-retirement

BlackRock Capital Market Assumptions:

https://www.BlackRock.com/institutions/en-us/insights/charts/capital-market-assumptions

BlackRock LifePath K Shares Fact Sheet:

Very insightful post. I look forward to part 2