IPERS Part Trois:

The Iowa Two-Step

A quick review: since 30% of IPERS’ ~$45 billion portfolio is benchmarked against itself, IPERS’ overall returns don’t tell us if IPERS’ investment returns are any good (or bad).

To wit: the fund’s private equity investments could go to zero and IPERS’ relative results would not suffer. Does that seem like helpful information?

It gets worse. IPERS uses this bogus benchmarking to argue that the plan has low risk.

How do they do it?

In IPERS world, one risk dimension gets much focus: tracking error. This is a measure of the degree of fluctuation of IPERS’ portfolio returns compared with the fluctuations of the benchmark returns.

As IPERS’ private investments’ returns are simply compared to themselves, the funds’ tracking error measure is meaningless.

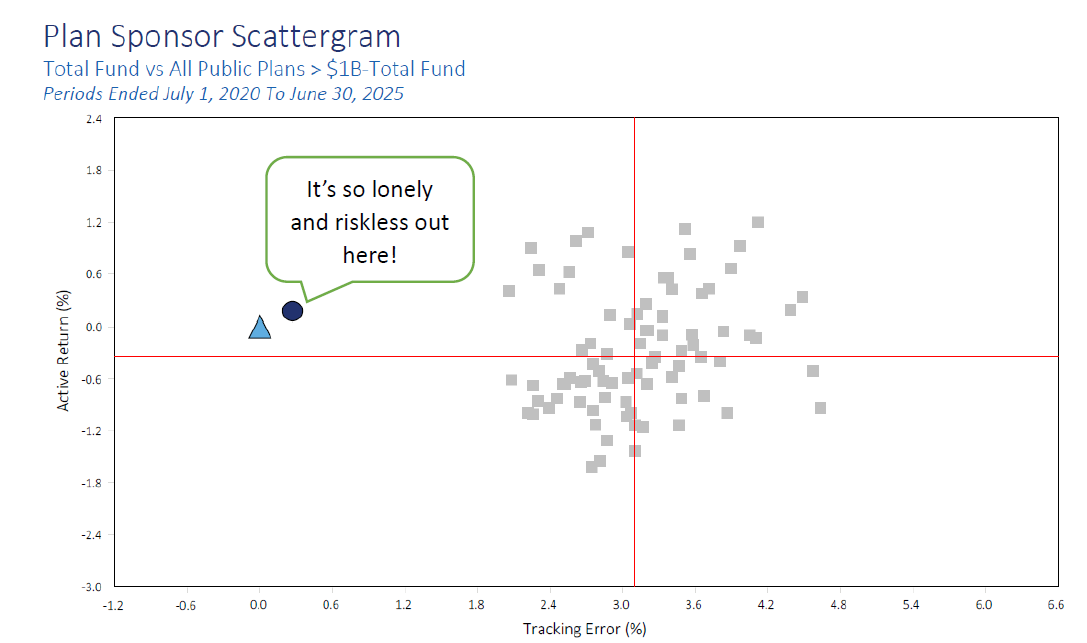

This does not stop IPERS and their consultant, Wilshire, from arguing that their fund’s risk is lower than all of the rest:

The scattergram suggests that IPERS is the only public plan in its peer group that measures it their (wrong) way. Wilshire’s (IPERS’ consultant) inclusion of IPERS’ policy benchmark (the blue triangle) on the below suggests that they, too, understand that IPERS likes to measure things, errr, differently.

Other measures contradict any suggestion that IPERS’ approach is low risk. While this is also obvious from a cursory view of IPERS’ asset allocation, a concern is that IPERS’ board (and Iowans in general) are getting snowed by IPERS management.

A returns-based style analysis from Markov Processses, a respected risk analytics firm, suggests that IPERS is among the most levered funds out there:

Benchmarkium ad Absurdium

IPERS’ performance benchmarks look cynically engineered to create the appearance of outperformance (aka alpha). Much, possibly all, of it is not real.

IPERS’ favored risk measure is gamed.

This approach has worked for IPERS the institution. But good governance would recognize that what is good for IPERS is not necessarily good for Iowans.

Iowans would—at a minimum-- do well to ask for better, fairer benchmarks and more complete (and correct) risk disclosures. To us, the claims made in the recent lawsuit don’t look at all frivolous.

Resources:

Wiggins Petition, July 14, 2025

“The Sharpe Ratio Broke Investors’ Brains,” Institutional Investor. Rich Wiggins, November 2020

IPERS investment information (IPERS’ website contains Annual Comprehensive Financial Reports and additional other reports).