Listening to Meb Faber’s (excellent) podcast recently, we learned of a new fund launched by Ivy Invest, which aims to bring the endowment style of investing to the masses.

As skeptics of the endowment model, our team of researchers looked into the fund’s materials online. We found some wonky stuff!

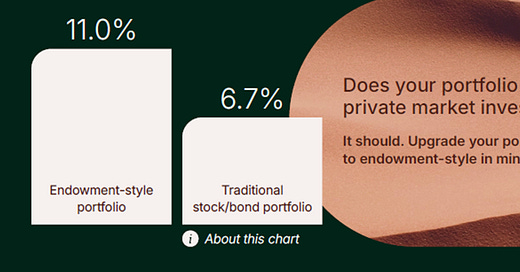

Ivy Invest says that the endowment model “has generally generated better returns vs. traditional stock/bond portfolio” as shown in the 10-year returns below. (1)

At first, we thought it was very helpful that Ivy provided performance context, rather than simply say “endowment style portfolios returned 11%, isn’t that good?”

Then we wondered, 11% seems kind of high. What’s in Ivy’s “endowment style portfolio”? And what is in the comparison portfolio?

The endowment style portfolio has a 45% weight in the stocks of the S&P (which returned 12.8% annually). Are the stocks in the traditional stock/bond portfolio the same stocks?

No, they are not! The sorry equities in the “traditional stock/bond” portfolio were represented by MSCI AWCI, which returned 8.7%. Cheeky, right?

We also noted that Ivy (a young fund) has already changed one of the fund’s benchmarks (including retroactively)(2) from the S&P 500 to the MSCI ACWI index to

“Better reflect its investment strategy, which may include investments in foreign and domestic equities, both public and private.”

Except get this: in the same document, the fund’s equity securities list are companies of the S&P 500, and in the most recent prospectus suggests that’s still the plan (3)

We asked Ivy Invest:

1. Why they used two different equity indices in their Endowment style/ Traditional comparison, and

2. Why they changed their benchmark to the MSCI ACWI if all of their listed equity holdings have been (we believe) and remain (as of the filing when they made the change) US-listed.

Ivy did not respond to our emails.

The Alt View team is at once disappointed in Ivy’s distorted presentation but impressed with their creativity and brazenness. Should we laugh or cry?

To capture our mixed emotions, we have decided to create a new *award.* Accordingly, The AltView awards its inaugural ‘Whatever it Takes’ marketing creativity award to Ivy Invest for:

Making lemonade out of lemons: turning a daunting marketing challenge into a distinct advantage by:

Leveraging strong S&P performance in the name of promoting alternative investments, while comparing them against weaker MSCI ACWI returns, all the name of making endowment returns look better.

You’ve set the bar high, Ivy!

PS: We admit it: it is kind of fun to call out these practices. But our real goal is to show investors and fiduciaries why they should be more skeptical about Alternatives. OF COURSE those selling Alternatives will say they are good. READ the footnotes. If it seems too good to be true, it probably is.

(1) https://www.sec.gov/Archives/edgar/data/1976685/000197668524000261/ivyinvest.co.pdf

(2) Yes, amazingly this is allowed, we will be writing about this practice soon, as around 30% of mutual funds have done this at least once. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001976685/000197668524000279/iisf-20240930.htm

(3) https://static-assets.ivyinvest.co/iisf_prospectus.pdf