Add Mercer to the ever-growing list of firms juicing Alts return assumptions in the apparent interest of getting Alts into 401(k) plans.

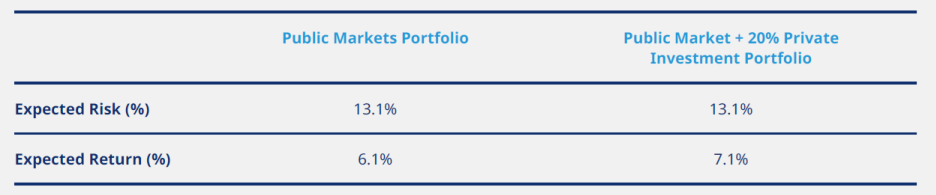

Recent Mercer research highlights that by adding a 20% private investment allocation, a retirement investor’s expected (20-year) return can be increased from 6.1% to 7.1%.

Source: Mercer

AWESOME! Who needs a presidential decree to jam alts into 401(k)s?

But wait. Maybe we should read the fine print.

Source: Mercer

Turns out, to get the (illustrative, hypothetical) result, we can’t just invest in any private investments, we need above average returns. We need some alpha! And like Neuberger Berman and Willis Towers Watson, we also need to make sure that we can’t generate alpha in other, boring, low-cost asset classes.

Since Mercer’s report does not share (among other things):

1. The amount of assumed alpha for private investments; and why Mercer assumed it;

2. The overall returns for private investments;

3. Overall returns for other assets;

the Alt View asked Mercer for details.

In an ongoing pattern, Mercer did not respond to our repeated emails. So we guess we can also say that the assumptions, in addition to being illustrative, are also secret, or at least privileged.

it would make sense….

If assuming above-average performance of private market investments is Mercer’s way of saying that you need to be a special type of investor in privates to make it worthwhile (we’d agree!), then they chose a funny way of presenting these details, buried in a footnote and all.

If, on the other hand, Mercer’s objective was to gloss over the question “should I invest in alts at all?” then, well, the presentation makes a lot of sense.

We see this all the time

When fiduciary clients accept this approach-and they often do- it allows a consultant or investment manager to quickly move to stage two: picking funds. This means that the client-fiduciary can be invested in, say, private equity, without having an explicit return expectation that returns will be higher than public equities. Such a low standard would be bad (for the vulnerable-to-litigation-alts-investing 401(k) plan sponsors of the future), but welcomed by PE managers….

All of this criticism is getting old: it’s time to start offering solutions.

Below are some Alt View suggestions. We will use private equity as an example because it would seem very difficult for a fiduciary to decide to invest in PE without an expectation of outperformance over public equities.

1. First principles. If considering investing in private equity, form your own opinion about the return prospect for the asset class before talking to people that sell private equity for a living.

2. Understand and Consider Agency Conflict. It’s part of your job. Ask the party (the consultant in this case) the question: how much revenue will you earn if we invest in PE and or VC vs. sticking with, say, an indexed 80/20 portfolio? Get a real answer, one that has numbers in it. Consider how the answer matters to you.

3. Define (long-term) expected return. The PE manager should be able to declare that they expect their funds to outperform a public equity index by some margin (over the long term). A good rule of thumb: if you can replace “lottery ticket” with “fund” in their language about prospective returns, you have a problem: “May” is not good enough. We’d argue at the very least, 2% per annum is a reasonable standard. The manager should be comfortable writing this down. And remember, IRRs cannot be compared with equity index returns! We’d recommend avoiding reference to IRRs at all.

4. Validate. The Consultant (if there is one) should validate/bless the fund manager’s return expectation.

5. Validate (again). The client/fiduciary/plan sponsor should then validate the Consultant’s and manager’s return expectation. It could be that the client actually thinks things will work out better than the other parties expect! Or maybe worse, but still worth doing. The point is that the plan sponsor/client is still a fiduciary and should not shirk responsibility.

The idea is NOT to set service providers up for a thrashing if things don’t work out, much less a lawsuit. Investing includes risks, after all! Rather, the point is to sharpen expectations and accountability for everyone involved.

Resources:

https://www.mercer.com/assets/us/en_us/shared-assets/local/attachments/pdf-private-investments-in-dc-plans.pdf

The Mercer report, like others we’ve seen, also cites (but does not discuss: did the authors of the Mercer report read it? Did anyone besides us?) a DCALTA/IPC paper, “Why Defined Contribution Plans Need Private Investments” that suggests that “Alts Always Win.” Our criticism of that report is here:

https://www.linkedin.com/feed/update/urn:li:activity:7308122967039725568/

"Diversifying Private Equity", Gredil, Liu, and Sensoy: shows data on PE fund of funds returns.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3535677